Protect your loved ones

Income Protection

What would happen if you lost your income?

For a lot of us, this is a real issue and losing an income stream can have devastating effects on a family’s quality of life. Income protection provides you and your family with a fixed monthly payment if you suffer an illness or accident and cannot return to work.

This type of insurance policy can provide a much needed safety net against essential monthly expenses, such as mortgage payments, rent and food costs, especially in times where cost of living expenses are on the rise.

How does income protection work?

- It provides you with a tax-free monthly payment that replaces part of your income if you are unable to work due to illness or accident.

- These payments continue until you can start working again, you retire, die or reach the end of the policy term.

- An income protection policy can pay up to 50%-60% of your income if you are unable to work

- You can claim more than once if you become incapacitated more than once.

- You can protect your income against inflation, so that inflation does not erode the value of your monthly payments over time.

Who needs income protection?

- If you are self-employed or a small business owner, as you may not have paid sick leave or paid annual leave.

- If you are an employee who only receives the minimum statutory sick pay (see FAQs for details on statutory sick pay in Gibraltar).

- You are the main breadwinner and have family members or dependents who rely on the income you earn.

- You have debt or financial obligations, such as a mortgage or rent, that you will need to make payments on even if you are unable to work.

What are the next steps?

Contact us on

- Personal circumstances analysis – we review your lifestyle and financial circumstances to see if income protection suits your specific needs.

- Budget analysis – we assess your essential vs non-essential spending and find out how much income protection insurance you really need.

- Medical underwriting – before the meeting, you can complete the Data Capture Form from the following link https://www.aiglife.co.uk/advisers/literature/forms. We will then process this on your behalf and you can have an underwriting decision in 3 days.

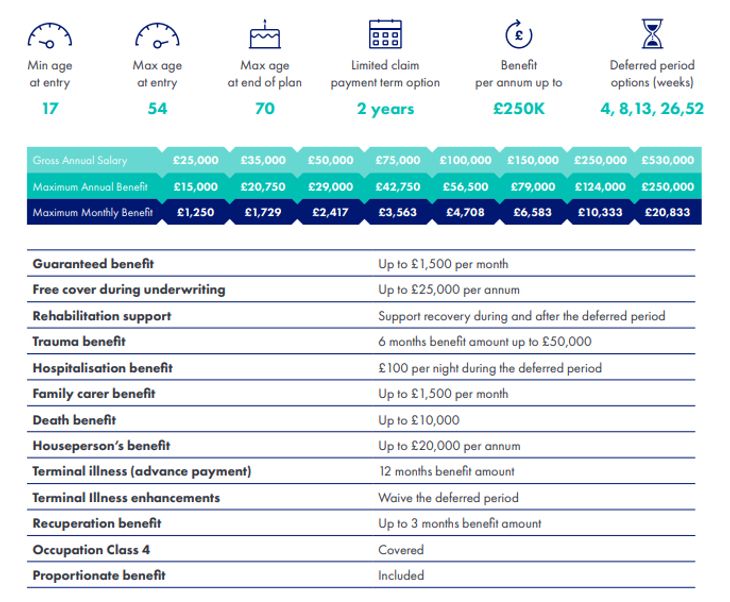

Key Features

FAQ

Abacus Wealth act as your financial adviser and insurance broker only and do not act as your insurance provider. We will assess the market for the right provider for you.

This depends on a few things. The factors below will all influence the price of your income protection policy:

- Your age

- Your health

- Your occupation

- Your smoker status – smokers get higher rates applied automatically

- The amount of the monthly payment – the higher the payment, the more expensive the cover.

- The term of the policy – the longer the term, the more expensive the policy.

- The length of the deferred period – the longer the deferred period, the cheaper the premiums.

The deferred period is the period of time from when a person has become incapacitated and unable to work until the time that the benefit begins to be paid. It is the period of time someone has to be out of work due to illness or injury before any benefit will be paid, and any claim payment will be made. When you take out AIG Income Protection, you choose a deferred period of 4, 8, 13, 26 or 52 weeks and you choose a limited payment term or full payment term. We will assist you in choosing the appropriate deferred period.

Gibraltar law only provides that companies pay their employees 2 weeks full pay and then a further 4 weeks half pay in any 12-month period. This means that after 6 weeks, your employer does not have to pay you anything else. It is crucial that you review your employment contract so that you know exactly how much and when your sick pay entitlement ends. We would look to match this period with the deferred period on your income protection policy.

In order for you to take out your income protection policy, you will need to be medically underwritten. This includes the completion of the Data Capture Form mentioned above and, depending on the answers you have provided, you may need to undergo a blood test, urine test and medical examination. Don’t worry, all costs are covered by AIG and all tests are done in local clinics.

Critical illness cover pays out a lump sum if you are diagnosed with a qualifying critical illness whereas income protection pays you a monthly income if you are incapacitated and cannot return to work for longer than the selected deferred period.