Establishing your goals and aspirations

Cash Flow Planning

Put simply, a cash flow plan is an assessment of your current financial life and a projection of your assets, liabilities, income and expenditure and how these will affect your life, especially when it comes to retirement. The ultimate goal of a cash flow plan is to see whether you will be able to meet, most importantly, your essential expenses but also your non-essential expenses in the long run.

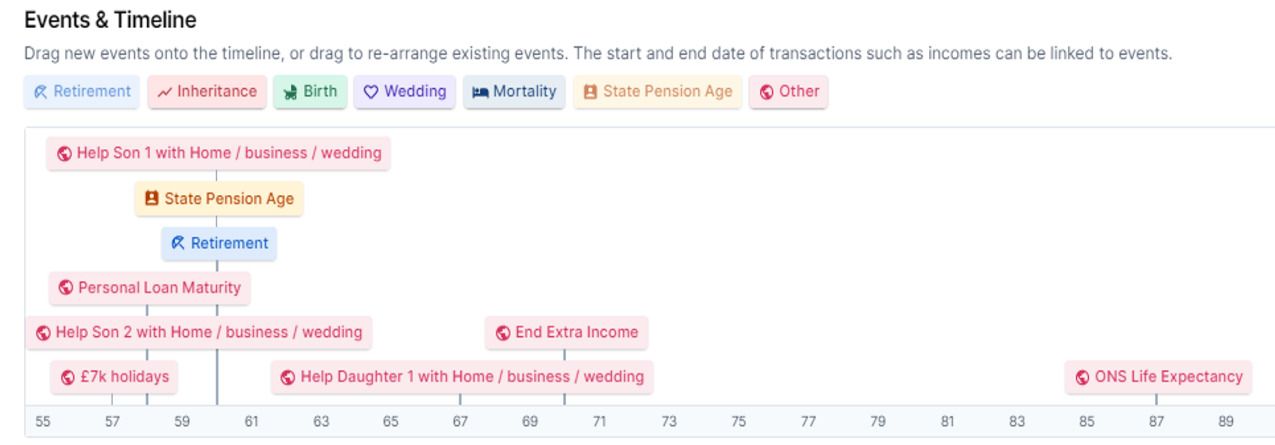

Our process begins by discussing and establishing your goals and aspirations. We then map out milestones within your lifetime on our cash flow planning tool. This can include:

-

When you would like to retire

-

When you are due to receive your State pension

-

Anticipated costs such as higher education for your children, or weddings.

-

Adding in all your assets, such as cash savings, investments, pensions and property

Following this, we will use certain assumptions, such as the rate of inflation, or the expected rate of return on any investments or pensions you hold and assess whether or not your expected income can meet your expected expenses in the future. Although not an exact science, this exercise helps you visualise how your financial life will look each year.

Once we have arrived at your “Base Case”, we will add on several “what if” scenarios and assess how these will affect your overall plan. For example, we include “what ifs” such as paying off your mortgage early, or taking additional income in retirement. Finally, we stress test your finances against market crashes and see what can be done to maintain a positive financial position.

As part of our advice process, we look to review this plan with you ever year and amend any changes that are required, it’s an ongoing process and Abacus Wealth are here every step of the way.