According to the Chinese calendar, 2022 is the year of the tiger. So, was it the king of beasts the one who bit off the market’s leg? In this Quick Note, we explore how and why a zodiac sign alone doesn’t explain the sharp reversal we have witnessed in global markets. We’ll go through the business cycle, and look for hints of where we are and we round it up by looking at the opportunities and dangers on the horizon.

Amongst all the uncertainty, we’ll start this Quick Note by outlining a few timeless truths:

1. Markets go down when there are more sellers than buyers, and they go up when there are more buyers than sellers. By buying and selling, investors “price in” their expectations. Gains and losses occur based on how reality transpires against those expectations. – If a company is expected to grow its revenue by 20%, investors will buy its shares in anticipation, but if it “only” grows by 15%, its share price will normally fall.

2. Price always equals the amount of money and credit spent divided by the quantity sold. If the amount of money or credit available increases without an accompanying rise in the supply of goods/services/financial assets, prices will rise (inflation). Equally, if the quantity sold decreases (i.e. supply disruptions) without an accompanying fall in money and credit spent, prices will rise (inflation).

Having established this, with the advantage of hindsight, we will dive into the reasons that led investors to sell their shares and bonds (thus pushing the price down), and buy the US Dollar and commodities (thus pushing the price up):

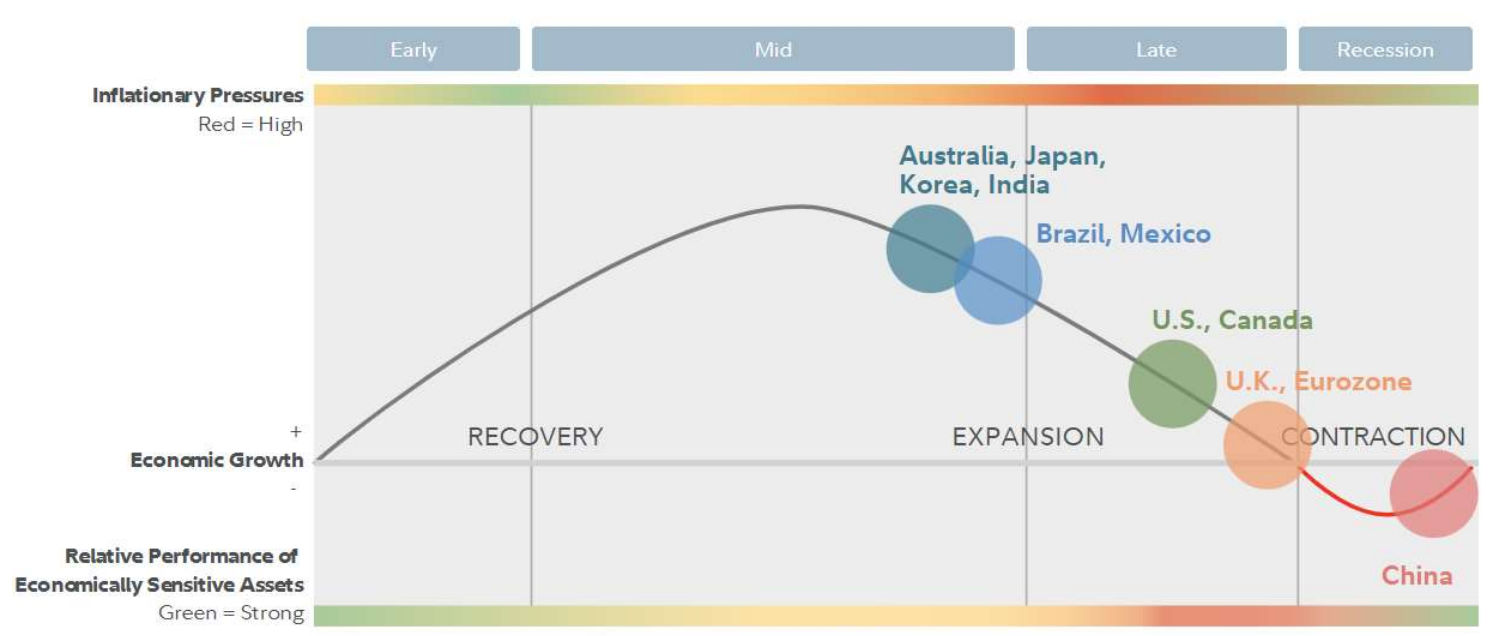

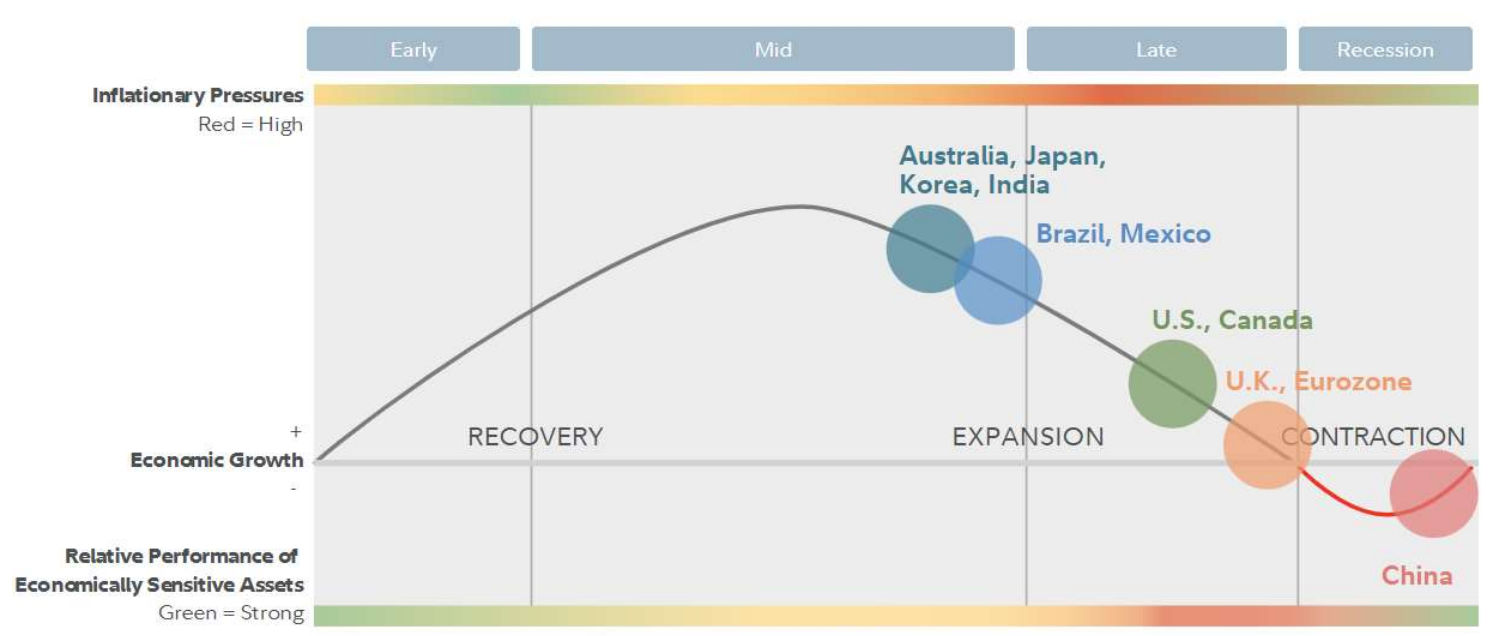

Understanding what’s happening: the Business Cycle is as old as money itself:

Source: Fidelity Business Cycle Update.

The consumer is the central piece of any economy, so to take the pulse of the economy, you simply need to gauge how much households, companies and the governments are spending. Let us now look at a template of the business cycle, and understand where we are today:

1. If the amount of money or credit available increases without an accompanying rise in the supply of goods/services/financial assets, prices will rise (inflation). Inflation can also arise from price spikes in raw materials (i.e. oil and gas), which increases input costs for companies, thus reducing margins and profitability.

2. Inflation squeezes household budgets by raising the cost of living (food, energy and other items of essential spending) at a faster pace than household wages. This dynamic forces consumers to cut back on all non-essential spending (i.e. buying a new car, holidays, leisure).

3. By virtue of 1) and 2), companies not only become less profitable, but they also lose revenue, which inevitably leads to cutting back on hiring or even firing some of their workforces to re�align budgets. So far this year, 1) and 2) have been in full display, but investors have more than started to price in the expectation that unemployment will rise in the near future.

4. To bring inflation under control, central banks raise interest rates, which diminishes credit creation (banks lending money to families and businesses), and forces consumers to cut back on spending, which in turn harms business revenues. How much central banks need to raise interest rates to bring the inflation genie back in the bottle depends on how much monetary excess they’ve allowed to accumulate in the system during the previous cycle.

5. The shift from low to high-interest rates hurts financial assets across the board due to 1) expectation of slower economic growth, 2) price adjustment as “risky” financial assets need to provide attractive returns over “safe” cash, and 3) less money and credit available to buy and invest.

1. Meanwhile, investors don’t just sell financial assets, they:

1. Rotate into “safe” financial investments like government bonds if inflation is

under control.

2. Rotate into “real assets” like commodities, gold, and infrastructures if

inflation is a worry.

3. In both scenarios, the amount of money that’s parked on the side-line, waiting

for better opportunities, increases.

6. The ensuing feeling of decreased wealth hurts business and household confidence, which has a detrimental effect on CEOs’ investment and expansion decisions, and shifts households’ willingness to save, away from spending. Both attitudes further contribute to a self-fulfilling downward spiral.

Eventually, a bottom is reached (as investments become priced at bargain prices), confidence indicators bottom out (as consumers realise that it’s unlikely to get much worse), or inflation peaks (signalling the success of the central bank’s inflation-combating measures), and the cycle resumes:

7. To bring economic growth back to an upward trend, central banks slash interest rates, which promotes credit creation (banks lend money to families and businesses, first to the most creditworthy, and just about to anybody at the end of the cycle), which pushes consumers to spend, which translate into higher company revenues, profitability, and hiring.

8. Economic growth rates rise, increasing inflows into capital markets, reinforcing optimism in the economy and in the good times ahead.

9. Eventually, indebtedness levels grow as businesses, governments, and households seek increasingly higher growth/returns, debt levels grow at a pace that’s faster than goods and services can be produced, and incomes can grow due to structural productivity and demographic trends.

And the perpetual wheel of motion continues, cycle after cycle.

The secret for successful long-term investing?

Not panicking.

One of the questions we get asked the most during times of market turmoil is “what shall I do?”. Let’s think about that for one second: if you, alone or with the help of a Wealth Manager, constructed a solid financial plan with an investment strategy that’s diversified and with a medium to long-term horizon, should you tamper with it at time where uncertainty is at its highest? We don’t think so.

Conclusions from the table above:

1. No single investment alone provides a better risk-reward than a diversified portfolio.

2. Losses, as measured by the % of negative months and the largest fall from peak to bottom

(maximum loss), are common and a natural part of investing.

3. The most volatile assets tend to carry the biggest losses, but also the highest yearly average returns. When diversified, risk and return are two faces of the same coin. Additionally, using data from the US Stock Market (S&P 500 Index with dividends reinvested) going back to 1927, we studied how investors would have done if they remained invested over different time periods. Here’s what we found:

1. 13.33% of 3-year holding periods registered negative returns, with the best 3 years registering an average annualised gain of 31.84%, and the worst 3 years registering an average annualised loss of -25.87%.

2. 6.82% of 5-year holding periods registered negative returns, with the best 5 years registering an average annualised gain of 28.44%, and the worst 5 years registering an average annualised loss of -8.42%.

3. 1.18% of 8-year holding periods registered negative returns, with the best 8 years registering an average annualised gain of 22.79%, and the worst 8 years registering an average annualised loss of –0.67%

4. 0% of 15-year holding periods registered negative returns, with the best 15 years registering an average annualised gain of 19.45%, and the worst 15 years registering an average annualised gain of 3.68%.

Conclusions:

1. In the short term, returns from investing in stocks vary dramatically but the longer you hold them, the better.

2. As your holding period/investment horizon increases, the possibility and magnitude of losses shrinks (you minimise downside), while your upside tends to remain high and stable.

The above results are not intrinsic to stocks, as we repeated it for other assets and the same conclusions were largely held. During our research, we also found that less volatile investments/portfolios (diversification is the best way to reduce volatility) registered less frequent, and shallower, losses.

Investing involves risks and is, by definition, uncertain. We recommend more than ever that clients' investment portfolios are risk-managed by professionals and that the portfolio is diversified across multiple asset classes, within multiple investment markets and preferred economic sectors.

Get in touch with one of our Wealth Managers to learn how to do just that.

Joao Feliciano Martins, CMSA, ACSI

Wealth Manager

Performance Monitoring Dashboard:

- Medium-risk (50% equities) portfolios year-to-date and last 3 years:

Performance ranking (best to worst) in USD:

- Commodities (Oil, Natural Gas, Copper, Platinum, Wheat, Corn, et al), +36.58%

- Physical Gold, -3.86%

- Broad Stock Market, -14.16%

- Long term government bonds, -23.15%

- Long term inflation-protected government bonds, -25.67%

Economies Monitoring Dashboard: