AWML Quick Note: 1Q2021 in Review

Welcome to our first AWML Quick Note, a series of occasional quick research and analysis pieces into current or historical topics affecting today’s financial markets, investments, and what they mean to your money.

Equities

Figure 1: Global equity indices in local currency terms.

Figure 2: GBP rose, while EUR and JPY fell against the US Dollar

The first quarter of 2021 was a good one for global equity investors, in US Dollar terms, American equities lead the way, but losses in the European (~3%) and Japanese (~6.5%) currencies boosted local currency returns, which is what we display in Figure 1. When European investors invest abroad, and the euro decreases in value/the foreign currency appreciates, the profits made abroad will be worth more when converted back to Euros. Let us use an example: if a British investor invests in Australian shares, and the Australian Dollar falls 10% against Sterling while Australian shares rise by 5%, the British investor will be down by ~5% when converting his investments to Sterling.

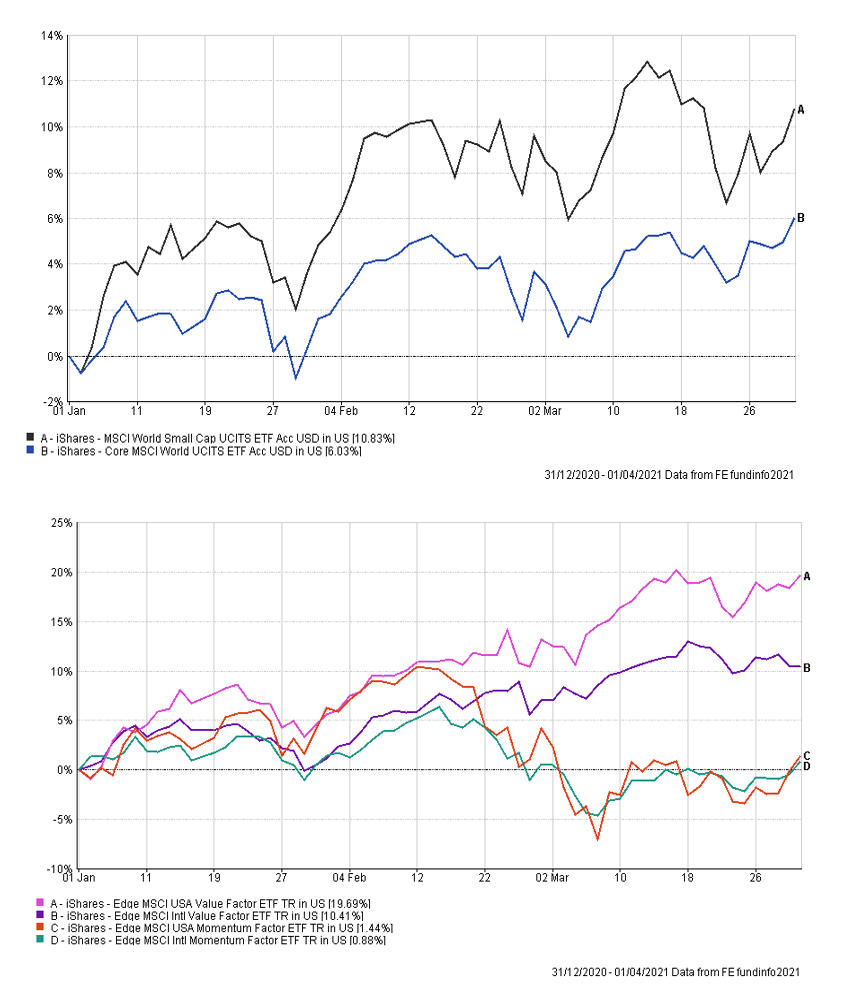

Figure 3: Global Small Caps VS Global Large Caps.

Figure 4: US & International Value Factor VS Momentum Factor

One of the main stories of the quarter was the long-awaited revival of “Value”. Value investing is often described as an investment style that focuses on buying “cheap” and mature businesses. The father of value investing, Benjamin Graham, taught at Colombia Business School and became famous with the rise of his most preeminent student – Warren Buffett. Value investors will typically look at accounting metrics like dividend yield (the dividend amount a shareholder receives as a percentage of their investment), Price-to-Earnings (a break-even measure of how many years’ worth of profits an investor pays) and Book Value of equity (the accounting value of a company’s assets minus its liabilities) to identify quality business trading at prices below intrinsic value. It sounds intuitive that investors would want to invest like this, but for the past decade, investors focusing on companies with high growth prospects, often with little to no earnings and negative cash-flows – momentum investors - have fared much better.

Low interest rates, central banks buying government debt, low economic growth rates and other “easy money” policies have often been cited as to why companies in the “momentum” space have outperformed their “value” peers. Both in the US and internationally, this trend reversed during the first quarter of 2021. Will this lead to a sustained outperformance of “value” over “momentum”?

As it typically happens in the early stages of the business cycle, smaller, higher risk & less global companies (small caps) outperformed the broader market. We interpret this as an indication that investors expect more robust economic prospects associated with successful vaccination programs in advanced countries.

Fixed Income

Figure 4: High Yield Corporates VS Investment Grade Corporates.

Figure 5: European & American Inflation Linked Bonds, Short Maturities VS Long Maturities

The same factors responsible for global equities’ positive quarter also help explain global fixed income’s sour performance in the first three months of 2021. The Covid-19 induced recession had a severe deflationary impact. The fact that investors are now expecting higher inflation in the short term corroborates that they believe in a sustained economic recovery. To explain what we meant here: inflation is a general rise in the price of goods and services, and it mostly happens because there is too much money chasing too few goods & services. During good economic times, wages rise, people consumer faster than goods can be produced, and banks lend freely to support even more consumption and investment, which usually results in increasing prices. Deflation is the opposite of inflation. Inflation is a negative phenomenon as it acts as a “tax” on consumers, but deflation can be even worse of a disease – a clear sign that something is wrong with the economy.

It is another indicator saying that we might be in the early stages of a new economic upcycle. Additionally, the main monetary and fiscal policy tools used by Central Banks and governments – money printing, fiscal stimulus, currency devaluations - are mostly inflationary by nature. Result: fixed income performed poorly in general, but inflation-indexed instruments and high yield (which tends to behave more in line with equities than bonds) acted as a backdrop - a point in favour of diversification.

Figure 6: Yield Curves in the US (left), Germany (centre) and UK (right) steepened, led by higher maturities- long end.

Valuations

Figure 7: S&P500’s Cyclically Adjusted Price-to-Earnings Ratio since 1880

Figure 8: FTSE International’s Non-Financial Price-to-Earnings Ratio since 2000

In previous articles published by Abacus Wealth Management, we discussed the crucial role valuations – typically measured as how many years’ worth of earnings investors pay to buy shares in a business, which is the definition of the Price-to-Earnings ratio (PE ratio) – play in forecasting future returns. In this first quarter of 2021, we saw valuations continue to rise for American shares (left) and British shares (right) alike. This tells us that shares got even more expensive over the last three months relative to their underlying earnings, which mathematically reduces future returns. It is also a sign of bigger investor confidence in the economy’s outlook.

If you would like a second opinion on making the most out of your investments or would like professional advice and guidance on how to protect/grow your pension or other funds, get in touch with Abacus Wealth Management. We offer an introductory meeting free of charge.

Joao Feliciano Martins,

Wealth Manager

Legal Disclaimer:

The information on this article is provided for information only and does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or otherwise transact in any investment including any products or services or an invitation, offer or solicitation to engage in any investment activity.

To the extent that this article contains any information regarding the past performance of products, such information is not a reliable indicator of future performance and should not be relied upon as a basis for an investment decision. To the extent that this article contains any information regarding simulated past performance, such information is not a reliable indicator of future performance and should not be relied on as a basis for an investment decision. Past performance does not guarantee future performance and the value of investments and the income from them can fall as well as rise. No investment strategy is without risk and markets influence investment performance. Investment markets and conditions can change rapidly, and investors may not get back the amount originally invested and may lose all of their investment.

There are significant risks associated with an investment in any products or services provided by Abacus Wealth Management. Investment in the products and services is intended only for those investors who can accept the risks associated with such an investment and you should ensure you have fully understood such risks before taking any decision to invest. We recommend that you seek professional advice before entering any transaction to buy or sell financial instruments.

Lastest Posts

- What is a Wealth Manager and Why Do You Need One?

- AWML Quick Note: Successful Investing During Market Downturns

- Inflation: The Silent Killer

- AWML Quick Note: 2021 in Review

- AWML Quick Note: 3Q2021 in Review

- AWML Quick Note: 1Q2021 in Review

- Spouses Pension! What Spouses Pension?

- Predicting The Future

- AIG Improve Their Critical Illness Offering – “Critical Illness Choices”

- Surviving in a Zero (Negative) Interest Rate Environment