Surviving in a Zero (Negative) Interest Rate Environment

“Risk comes from not knowing what you’re doing” – Warren Buffett

Investing was never easy. As humans, we are naturally risk-averse, and losses hurt us more than we enjoy equivalent-sized gains. You probably did not need to read this to suddenly become aware of it – this is encrypted in our brain and teams of psychologists and economists have gathered plenty of empirical evidence proving it.

This self-defence mechanism has been useful in our collective survival, but prosperity and recognition reward the wise risk-takers, innovators and entrepreneurs. To put it simply: avoiding risks allows us to survive but knowing when to take risks allows us to thrive. What constricts us from taking more potentially rewarding risks? Lack of knowledge – we fear what we do not know!

One of the biggest unknowns, if not the biggest, is how will investors be able to squeeze a profit from their savings and pensions in a world with 0%, or negative, interest rates? The days where one could safely park his/her savings in a bank deposit, or government bond (lend it to the government) and collect a 2-4% interest rate are long gone. Below, is a table summarising the interest rates currently available in the above-mentioned investments:

Figures are correct as at the 04/11/2020

How Does this Impact My Long-Term Financial Goals?

Let us use two examples: Jane and Nicole

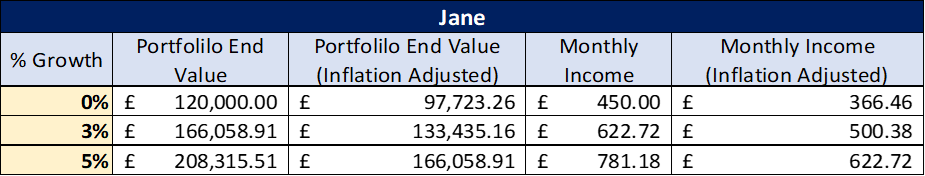

Jane intends to retire in twenty years’ time, and she is saving £500 per month into her retirement fund. Depending on different growth rates and assuming an inflation rate of 2% per annum, how much can Jane safely withdraw from her retirement fund every month, with very little risk of exhausting the fund?

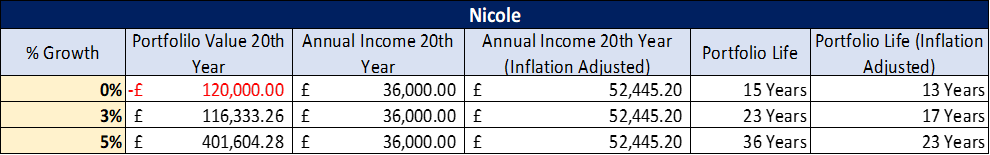

Nicole is 55, retired, and she has a £600,000 pension fund from where she withdraws £3,000 per month. Depending on different growth rates and assuming an inflation rate of 2% per annum, how many years can Nicole expect her pension fund to last?

Answers:

Notes: 1) all dividends are reinvested and compounded; 2) we assume a perpetual 5% withdrawal rate for Jane at retirement; 3) for Jane, we adjust the annual growth rate for inflation; 4) for Nicole, we adjust the annual income by growing it according to inflation; 5) Portfolio Life reflects the number of years before the portfolio is exhausted; 6) the % growth rates shown are net of all fees and charges.

A few key issues immediately jump to our attention:

- Not investing always leads to the worst outcomes – erosion of purchasing power and early fund depletion.

- When we consider that the average retiree’s lifespan is circa 20 years, the risk of outliving one’s savings is quite high when the investor doesn’t take on sufficient investment risk (3% growth rate is representative of a cautious portfolio while 5% growth rate is representative of a balanced portfolio) and one can even argue that longevity risk is higher than investment risk for some individuals.

- Investors need an attractive return if they want to meet their financial goals.

- Some of the most common alternatives to taking more investment risk involve concessions and sacrifices – a combination of saving more/spending less or postponing retirement date, to name a few.

- Costs directly impact performance. Every 1% of additional fees you pay will reduce your chances of financial success. At Abacus Wealth Management, we are transparent and fair with our charges because we measure our success based on your success.

- Net performance after fees is the main driver of good investment outcomes, not performance before costs, nor the total level of charges - they are all inter-connected.

If you can relate with Jane and Nicole’s situation, Abacus Wealth Management has the tools, knowledge and licenses to help you. Hoping it all works out well in the end is not a recommendable strategy. Hope leads to hopeless, and eventually hopelessness.

Investing During Zero (or Negative) Interest Rate Periods:

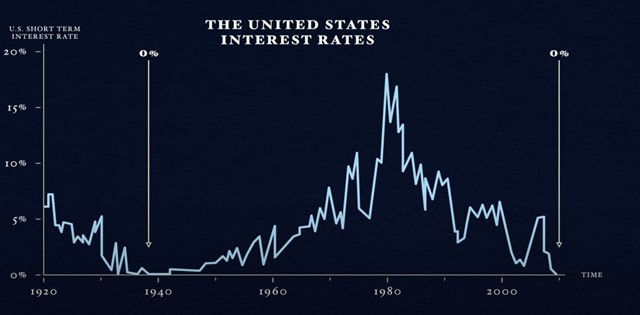

To complicate matters even further, we have the “unprecedented” challenge of having to invest with interest rates at historically low levels – something we “haven’t seen before”. How are you positioning yourself to protect your portfolio in lieu of these circumstances? Is your adviser openly discussing all the potential implications and outcomes? What if I told you that we have faced similar circumstances in the past, just not during our lifetimes?

Source: Bridgewater Associates

Source: Bridgewater Associates

The first time the Federal Reserve (America’s Central Bank) cut its interest rate to the 0% bound was in 1933. At the time, America (and the world) were desperately trying to recover from a global stock-market-crash-induced-depression. The second time was in 2020, when the world is trying to recover from a global-pandemic-induced-recession. History does not repeat itself, but It does often rhyme.

Believing that knowledge is power, we at Abacus Wealth Management embarked on a mission to study this period and hopefully draw some lessons on how we can best advise our clients to navigate, and protect their wealth during through these agitated market waters. To do that, we compared the inflation adjusted returns of investing in shares (S&P500); 3-month Treasury Bills (a proxy for cash); US Government Bonds (“risk-free” investment) and Gold during the 1932-1941 period:

Source: Bloomberg Data, Abacus Wealth Management Calculations

The data shows us unsurprising results: in a world where investors have few reasons to invest in cash, or cash-proxies, risk assets register positive but below-average performance figures. Meanwhile, stocks and gold tend to benefit from the increased build up in credit and money printing, usually associated with extremely low interest rates. Another unsurprising discovery is that periods of zero (or negative) interest rates tend to coincide with periods of high valuations across financial assets, which constrains future performance to below average levels, but still well within positive territory.

Lastly, we find it worth noting that prolonged periods of interest rates at 0% can last surprisingly longer than what people originally expected, and that cash is the worst performer of the traditional investments during these periods. We do not need to look too hard for evidence on this. The Japanese Central Bank first cut their interest rate to zero in 1999, only to reduce it to -1% in 2016. The European Central Bank also cut its interest rate to 0% in 2016. Both central banks have publicly stated that interest rates are going to remain “very low” in the next three years. Who has suffered the most with this policy? Savers. Meanwhile, investors in European Equities (Euro Stoxx 600 Index) and Japanese Equities (Topix 100 Index) have enjoyed gains of 13.68%, and 10.89%, respectively, in the 2016-2020 period.

You might be thinking this is too complicated for you to handle by yourself… We have good news: you do not need to. By working with an Abacus Wealth Management advisor, you benefit from having our knowledge and tools on your side. Contact us or book an appointment via our website, If you are unsure about how you can position yourself to take advantage of this confusing market-environment, or simply wish to protect yourself, and your family, against nefarious market movements. We hope to hear from you soon.

Joao Feliciano Martins,

Wealth Manager

Lastest Posts

- What is a Wealth Manager and Why Do You Need One?

- AWML Quick Note: Successful Investing During Market Downturns

- Inflation: The Silent Killer

- AWML Quick Note: 2021 in Review

- AWML Quick Note: 3Q2021 in Review

- AWML Quick Note: 1Q2021 in Review

- Spouses Pension! What Spouses Pension?

- Predicting The Future

- AIG Improve Their Critical Illness Offering – “Critical Illness Choices”

- Surviving in a Zero (Negative) Interest Rate Environment